Some Known Details About Lighthouse Wealth Management, A Division Of Ia Private Wealth

Wiki Article

The Basic Principles Of Lighthouse Wealth Management, A Division Of Ia Private Wealth

Then, via coaching and accountability, a consultant can help you follow up on the actions needed to stick to your plan. What good is a monetary strategy if you don't follow through? An expert can assist you do that. Many Christian financiers do not wish to make money from service techniques that they differ with such as abortion, porn, or addictive items.

If you would such as the assurance this kind of partnership can bring, contact us to start a discussion regarding your goals - https://hub.docker.com/u/lighthousewm.

They will certainly suggest appropriate monetary items and techniques based solely on your needs and objectives. tax planning canada. This impartiality can provide you with the self-confidence and satisfaction that your monetary decisions are knowledgeable and concentrated on your ideal interests. Lots of people have financial goals, such as purchasing a home, repaying debt, saving for education, or retiring conveniently

Lighthouse Wealth Management, A Division Of Ia Private Wealth - An Overview

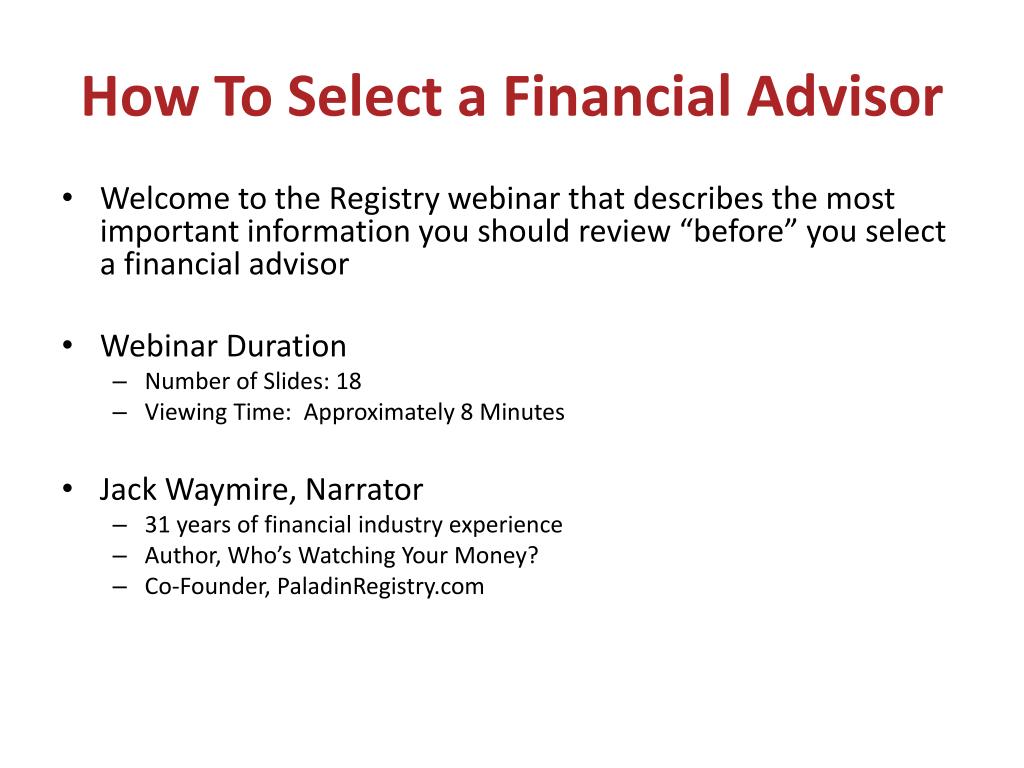

When picking an economic consultant, several essential factors ought to be thoroughly considered to ensure you locate the best expert who aligns with your monetary goals, values, and needs. Here are some important aspects to take into consideration during the selection procedure: Seek a financial advisor with the suitable qualifications and certifications.

These accreditations suggest that the consultant has gone through strenuous training and fulfills market requirements for experience and ethics. A critical element is guaranteeing that the monetary advisor sticks to a fiduciary requirement. Fiduciary experts are legitimately bound to act in their customers' best passions in any way times. This commitment makes certain that the recommendations and suggestions you receive are unbiased and prioritize your monetary well-being.

Determine the range of solutions used by the advisor and assess whether they align with your particular economic demands. Some advisors might concentrate on financial investment monitoring, while others offer extensive monetary planning, tax obligation planning, estate planning, and a lot more. Select a consultant whose solutions match your demands. Take into consideration whether the expert mostly offers clients with comparable monetary scenarios or goals as yours.

About Lighthouse Wealth Management, A Division Of Ia Private Wealth

With a relied on consultant on your side, you can browse the complexities of the economic landscape with confidence.

Inspect the background of investment experts connected with this site on FINRA's Broker, Check. Though financial planning might provide both present and future independence, unfortunately, just 30% of U.S. homes have a long-term monetary plan - https://www.easel.ly/infographic/p5ajym. What is included in monetary preparation? And who may benefit from these solutions? Discover more regarding what financial preparation entails and simply a few of the advantages it might give.

In conclusion, having a monetary strategy might give advantages at practically every phase of life. Financial advisors with BECU Financial investment Solutions are right here to assist. Our group will make the effort to get to understand you, comprehend your goals and strategy and apply an economic technique that's suitable for you.

Little Known Questions About Lighthouse Wealth Management, A Division Of Ia Private Wealth.

You desire someone that has a deep understanding of tax law, insurance coverage, tons of numerous financial products, retired life methods, therefore a lot more. And there are great deals of them available. However first, comprehend what a financial expert's function remains in your monetary life and exactly how to choose the one that's finest qualified to help you meet your objectives.

Your advisor figures out how much cash you have now, just how much money you'll require for the future, and just how you'll expand it. The very first point a monetary expert does is pay attention and learn.

Many individuals will look for a monetary planner if they have money fears. The best monetary expert for you will certainly attempt and discover your fears and lessen your concerns through confidence, concern, and a minimum of a rough summary of first steps you can take to hop on the right course.

How Lighthouse Wealth Management, A Division Of Ia Private Wealth can Save You Time, Stress, and Money.

If you have a high internet worth, a challenging estate or tax scenario, financial consultants can use beneficial advice. They are additionally valuable for people experiencing a major life occasion, like retired life. If you value having somebody there to answer any kind of concerns you have concerning your funds, an advisor is likewise helpful.

"Retirement is truly just one piece of it. An excellent advisor functions collaboratively with the customer, to plan (and adhere to) a plan that enhances and sustains the client's way of life, no matter find what curveballs life tosses his or her means."In the past, individuals would certainly have chosen to deal with monetary advisors for portfolio rebalancing and tax obligation loss harvesting.

While this is still something several economic advisors provide, so as well do online investment systems. While economic consultants can be important for those with complicated financials or people that like to do points in personthey can feature a substantial rate tag. The costs they charge can consume right into the quantity of cash you really make from your financial investments.

The 3-Minute Rule for Lighthouse Wealth Management, A Division Of Ia Private Wealth

All of the consultants recommended by these organizations will certainly be fee-based CFPs. When talking with a potential consultant, do not mark down the importance of character.

Is your advisor using great deals of lingo and buzzwords and presuming you're more accustomed to complex financial ideas than you in fact are? That stuff is necessary. Your advisor requires to read signals and understand not just the kind of economic plan you're looking for yet the sort of discussions you wish to have concerning that monetary strategy.

This indicates they legitimately have to do what's in your ideal rate of interest. No matter of the cash they make or anything else they stand to acquire by handling your money, you can rest easy knowing they are making the right decisions for your cash. Before picking an advisor, think about communicating with a few experts to get a feeling for the sort of guidance and perspective you're trying to find.

Report this wiki page